UAE Company Formation & Market Entry Services Consultancy

Safest country in the world.

The right to live and run a business in Dubai.

Tax free income.

Move with your family.

No minimum investment amount required.

Business-Friendly Ecosystem.

*Government fee could vary depending on the client's requirement

Wherever you are in the world, You’ll find a comprehensive suite of services and the support of a consistent network of professionals.

UAE Company Formation & Market Entry Services Consultancy

Asset protection UAE / Dubai

UAE free zone set-up

Dubai LLC Set-up and Provision of (51%) corporate sponsor.

International Offshore Company Formation including BVI, Nevis, Maydan Free zone, Cook Islands

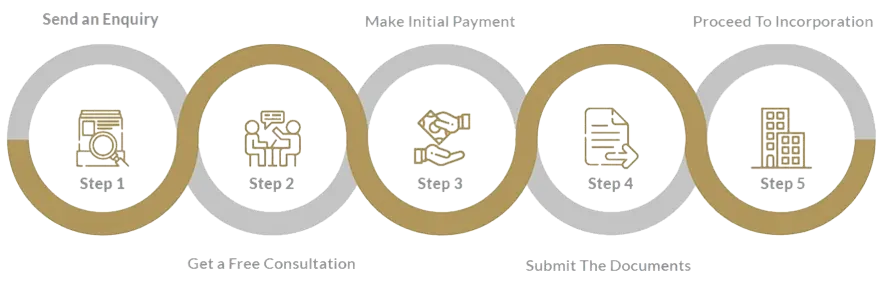

Experience World-Class Business Consulting from our experts on Company Formation process and procedures in the UAE.

We will guide you throughout the Company Registration process and further. Our PRO Agents will ensure you receive the business license at the earliest.

Leave all your Administration works to us. We will assist you with the documentation, application form preparations, and the payments required for your Company Formation in the UAE.

Our dedicated PRO Service Agents will assist you in applying for the Residence Visa, Emirates ID & Corporate Bank Account in a seamless way.

“We started working with Global Migrate more than 4 years ago and since then our relationship has grown significantly spanning across projects both domestically and internationally, notably KSA, assisting us on all corporate service and company formation / management. Global Migrate have become a trusted partner on complex structuring and company structure management. They continue to be our preferred corporate services provider and look forward to developing our working relationship with the Global Migrate team further.”

“We have been working with Global Migrate in Saudi Arabia since 2020. Dan and the KSA team handle all aspects of our post licensing registrations and immigration requirements. The team at Global Migrate provide regular, transparent communication and excellent ongoing support services. This has allowed us to focus on what matters most to us – the running of our business.”

As a corporate & tax advisory firm focused on internationally active private clients, it is absolutely essential for us to work with the right that can deliver reliable cost efficient execution services. It has been fantastic working with the Global Migrate team on a variety of wealth succession structures especially the ADGM Foundations and SPVs.

The Emirates protects the rights of investors by providing equal business opportunities for foreign and local entrepreneurs.

Freedom to deposit and withdraw funds, no currency controls simplified KYC procedure for transactions in the local currency.

The legislation ensures the confidentiality of information about foreign business owners who have registered a company in the UAE.

0% basic tax (corporate,personal income, dividends). 5% VAT for a number of internal operations.

All business owners can get a residence permit and then a tax resident (domicile) status, which shields them from CRS (exchange of tax information).

A company operating in the Emirates receives a TRN number, which provides confidence and validation for foreign financial institutions and others.

As the Middle East’s aviation hub and with the largest cargo port in the region, the UAE is perfectly placed as the intersection of Europe, Africa and Asia.

Unified tax and customs regulations mean duty-free free trade agreements across 6 of the Gulf Cooperation Council (GCC) countries.